In 1952 Ralph Ellison wrote a book called "The Invisible Man" about being of some African ancestry in the USA. It essence the thesis was if you were "negro" (the term in those days, as odious to me as "black") you were invisible in USA, for white society did not wish to acknowledge you or your contributions. The book was in the liberal canon for a good thirty years, so when I heard this new term, credit invisibles, alarms went off.

Apparently there are 20 million people, mostly "blacks" and hispanics, who have no credit scores. Since government only addresses problems that do not exist, the paper argues that society must do something (spend money) to fix this problem. Since no one has asked for help, this is an ideal problem to solve. (

Report opens as a .pdf.)

Now what these people do not have is a paper trail of credit that allows them to be scored. That is because they get what necessary and sufficient credit they need from organic sources, probably at no interest, from friends and relatives and merchants who extend them credit.

In essence the proposal is to extend credit to people based on whether they make regular utilities payments. Got a phone bill and a gas bill? Good enough to get credit.

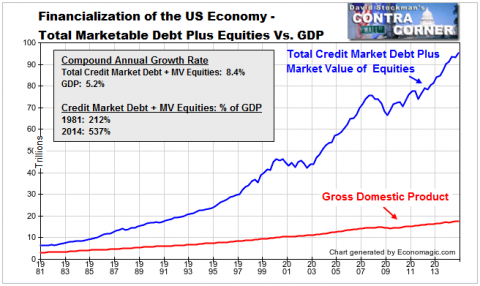

Now these people are getting along finr without credit, but since we have hyper-inflation in credit, the hegemon is looking for new users of credit. By flooding low-income communities with cheap EZ credit, in essence $2 Trillion Zimbabwe notes, these people will contract to pay for things they cannot afford, go bust, and be on the records as bad credit.

The main thing is they will be on the record, for when it comes to some national emergency, and all hands are needed for whatever.

So there is in fact a problem, the banking system is Kaput and it is looking for fresh victims, and they have found 20 million of them. That is more people than most countries. The recommendation that credit be extended based on utility bills is funny, because every used car dealer and rent to own furniture house does exactly that. This effort is merely to transfer abusive lending from Honest Dave's EZ Credit Furniture and UNeeda Car Now! to the Federal Reserve System.

Mish covered this from his view as an investor, and I am covering from the view of small business. This proposal to frack the rest of the possible credit opportunities ought not be done, but it will. It will make a small business renaissance harder, and destroy what is left of the inherent community building that occurs when credit at no usury is extended among merchants and consumers.

The report betrays a ignorance of economic history:

With our existing data, it is difficult to determine to

what extent this reflects an age effect (a greater tendency of credit histories to shrink or become

stale with age), a cohort effect (in which people born earlier than 1950 had thinner credit

histories over the course of their lives, possibly reflecting less credit reporting during the periods

of their lives when they were actively using credit), or some combination.

Well, older people never needed enough "reported" credit before the hegemon drove good credit out with bad credit. I have been bad-credit free (so stale and unscorable) for having not used any in the last five years. We simply do not need to access bad credit, there is enough good credit to thrive.

It will take self-discipline to avoid being trapped in this latest assault on minorities by the hegemon in the USA. We've done this worldwide for decades, and what goes around comes around, and this too is coming home. Live and work outside this system.

Feel free to forward this by email to three of your friends.