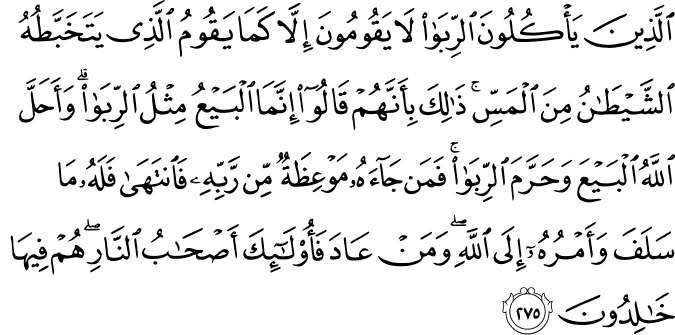

It is written:

Sahih International

Those who consume interest cannot stand [on the Day of Resurrection] except as one stands who is being beaten by Satan into insanity. That is because they say, "Trade is [just] like interest." But Allah has permitted trade and has forbidden interest. So whoever has received an admonition from his Lord and desists may have what is past, and his affair rests with Allah . But whoever returns to [dealing in interest or usury] - those are the companions of the Fire; they will abide eternally therein.The Prophet (PBUH) tells us Allah forbids usury (commonly referred to as "interest") and clearly distinguishes profit and usury as distinct events. This tracks old testament prophets and the Christian church as well.

Usury is not a sin because Allah says so, but because usury does damage. What makes a sin is harm or damage. Usury, commonly referred to as interest causes harm and damage, but the problem is it is not clear as to how this is so. It is so obscure, that our Creator required prophets to clearly condemn it, and the People of the Book and Mohammed to remind us again and again, usury is forbidden because it does harm.

Just what harm does it cause, and how? This is what goes unexplained. Modern economics explains present value theory, opportunity cost and other rational bases for permitting interest. Against this the best argument contra-usury is Aquinas:

Of the Sin of Usury, Which is Committed in Loans:

To take usury for money lent is unjust in itself, because this is to sell what does not exist, and this evidently leads to inequality which is contrary to justice....

Now money, according to the Philosopher (Ethics v, Polit. i) was invented chiefly for the purpose of exchange: and consequently the proper and principal use of money is its consumption or alienation

whereby it is sunk in exchange. Hence it is by its very nature unlawful to take payment for the use of money lent, which payment is known as usury: and just as man is bound to restore ill-gotten goods, so is he bound to restore the money which he has taken in usury....

A lender may without sin enter an agreement with the borrower for compensation for the loss he incurs of something he ought to have, for this is not to sell the use of money but to avoid a loss. It may also happen that the borrower avoids a greater loss than the lender incurs, wherefore the borrower may repay the lender with what he has gained. But the lender cannot enter an agreement for compensation, through the fact that he makes no profit out of his money: because he must not sell that which he has not yet and may be prevented in many ways from having....

It is lawful to borrow for usury from a man who is ready to do so and is a usurer by profession; provided the borrower have a good end in view, such as the relief of his own or another's need.

This is the same philosopher who teaches you cannot do evil to achieve good. Perhaps he is considering th Salvation army taking out bonds to finance a reconstruction after a natural disaster. But when such efforts are fully funded with charity, why bother and pay interest? In any event such arguments are hypothetical.Here is the problem: by the miracle of compound interest, power is aggregated in relatively few hands. This power is then used to distort markets by advancing or withdrawing economic support, through acts of malinvestment.

At the same time usurers are gaining purchasing power and market distortion potential, the borrowers on the reverse side of the magic of earning compound interest, those deluded souls who are borrowers experience the horror of owing debts that keep growing, and often find themselves trying to pay back debt with deflating currency or underwater on an asset for which they borrowed the principal. It is a highly leveraged trap that superficially appears beneficial but in practice is a dark art that drives souls ahead of it to misery and destruction. Farmers lose their land, small businesses lose their working capital, the elderly cannot afford their homes.

All evil is constrained by finance, it must be supported in time and place by capital. A truly free market doe not support the acquisition of exceptional wealth, and although it would permit usury, as a practical matter it would not obtain, because of two features of a free market - regulation and sanction.

In a free market there are no real regulations, simply counter-party actions. If people lent money at usury it is only a matter of time they begin fractional reserve lending. People observing these acts would short the bank stock, and do well when the inevitable bank-run occurred. Usury would be nipped in the bud. There are no central banks in a free market to protect usurers and fractional reservists.

A more direct sanction is the borrower simply does not pay the usury on the loan. A usurer may lend a million dollars, but in a year when the borrower returns it, he refuses to pay the usury fee. Yes the borrower has broken his word. This is where the sanction comes in. In a free market sanctions are limited by freedom to associate, and freedom of press. So when the borrower declines to pay the interest, the lender may raise a stink about the borrower. In the degree anyone cares, the borrower will be sanctioned. The borrower very well may find the sandwich shop owner will not serve him a sandwich. Or more likely, far more likely, is nobody cares and the usurer finds his work unrewarding.

Should the usurer resort to force, then he may find in fact no one will serve him a ham sandwich, to continue the meme. In the business world today, "law" enforcement is almost entirely reputation-related. It is necessary and sufficient to have such free market law enforcement, and as we see demonstrated daily in the headlines, the entire regime of "regulatory enforcement" is pointless featherbedding.

Wherein a Mother Teresa can do great good with no resources, a Hitler or a Capone cannot work without financing. The money necesary to do evil is gathered by usury. This link is so obscure that it is not clear that usury does damage. For this reason usury is forbidden by the prophets in an act of love by our Creator.

When an unwarranted cruise missile drops on a wedding in Afghanistan killing all except a few maimed little girls, it is essentially usury that makes that possible, with additional support from other financial crimes like fractional reserve, etc, which merely leverage usury with money substitutes.

Islamic scholars are struggling with the issue of usury right now on a global level. The Church did so 400 years ago and got the answer right, but begged off any opinion on modern finance on the excuse of not understanding how it all works. As with so much of Western Culture, within Islam resides much that can illuminate current discussions. Now to tap into that discussion, and urge freedom.

0 comments:

Post a Comment