I am no one to correct David Stockman, but there are some serious problems, I think, with this outburst:

Later he makes it plain:

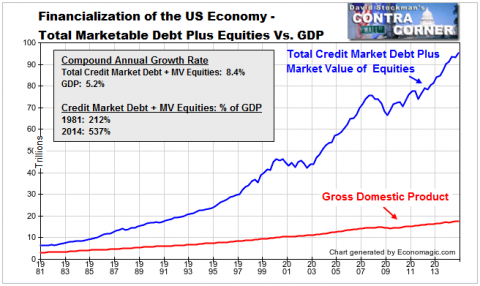

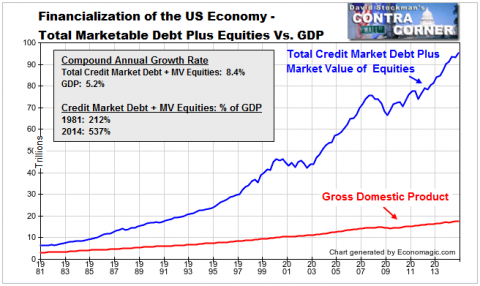

The blue line is claim on assets. The red line is the productive economy, the asset base upon with the claims rest. Got problems?

Feel free to forward this by email to three of your friends.

To wit, free money does immense harm by fueling rampant carry trade speculation; there is zero evidence that 2% inflation results in any more growth than 1% or even 0% inflation; and, as an empirical matter, there is plenty of inflation in the US economy and has been during the entire past 15 years of rampant money printing designed to stimulate more growth.First is it money that is free, or asset-backed-free credit fueling rampant carry trade? Yes, inflation results in growth of something, by definition, the question is what grows and for whom? The answer is malinvestment and misallocation, in which the losses are socialized and the benefits privatized. And then again, how is he defining money in this riff?

Later he makes it plain:

No, the financial economy has ballooned from 2X national income (its historic level) in 1981 to 5X today for one reason alone: Namely, owing to the massive borrowing spree and asset inflation generated by the Fed’s destruction of honest price discovery and discipline in the nation’s financial markets.Note this chart -

Stated differently, the $92 trillion number for equities and credit market debt shown below would be about $35 trillion under the traditional monetary regime that had supported steady growth of the US economy and household real incomes for nearly a century prior to 1971.

The US economy is thus imperiled by a $50-60 trillion financial bubble.

The blue line is claim on assets. The red line is the productive economy, the asset base upon with the claims rest. Got problems?

Feel free to forward this by email to three of your friends.

0 comments:

Post a Comment