I do not think Stockman would mind me amending his statement to red from “welfare state America ‘ to “Welfare/warfare America”

In welfare state America its virtually certain that through one artifice or another taxes will go up and the national debt burden will rise to crushing heights in order to keep the baby boomers’ entitlements funded. While Keynesians and Wall Street stock peddlers are clueless about the implications of this——it actually doesn’t take too much common sense to get the drift. Namely, under a long-term path of fewer producers, higher taxes and more public debt, the prospects for rejuvenating the previous historically average rates of real output growth are somewhere between slim and none—-to say nothing of the super-normal rates implied by the markets’ current bullish enthusiasm.

As we explained a few days ago, the growth rate of the US economy is in a profound downward trajectory. Based on even the deficient national income and products accounts (NIPA), the growth of real final sales has dropped from 3.6% per annum during the golden era of 1953-1971 to only half that level or 1.8% since the year 2000, and to only 1.1% since the pre-crisis peak in late 2007.

So welfare warfare cannot be sustained... the stocks, real estate, delusional bond valuations (based on notional derivitive values) pensions O Lord!~ it is all becoming such a hash, a lifetime work just to sort out your plea for what is yours.

Or turn away:

So absent the Fed massive money printing campaigns since 2000 and the resulting drastic falsification of financial prices, cap rates or PE multiples would be going down, not stretching into the nosebleed section of recorded history. But in a central bank driven casino, there is no honest price discovery or discounting of the forward prospects for business growth and profits. The only thing that is actually “priced-in” is the expected short-term actions by the FOMC—–where today the consensus quickly concluded that the dreaded day in which carry trade gamblers would be required to pony-up the onerous sum of 25 bps for their chips would be deferred until September.

That whole game is over, in destructive mode.

Ignore all of your “assets” assume there is nothing worth you claiming.

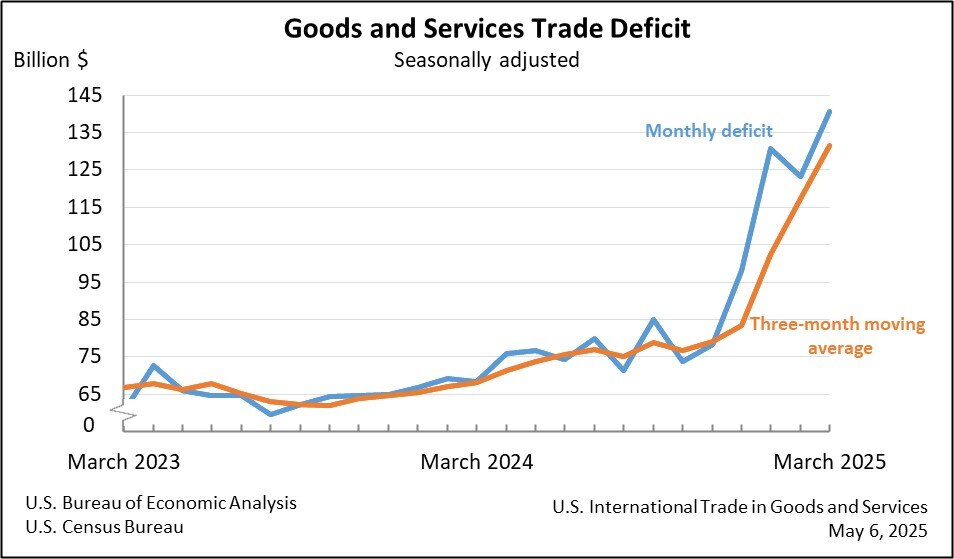

Join in the solution of starting your own business. if int'l trade is in your plans, I have various options on the upper left links on this page. International trade is still strong, the stability in the small business sector.

|

| http://www.census.gov/foreign-trade/data/index.html |

Feel free to forward this by email to three of your friends.

0 comments:

Post a Comment