I've learned a lot form the Christian anarchist Dr. Gary North, all the while aware of his anti-Catholic bias. Brother Jimmy Swaggart has nothing but deconstruction for Catholicism, but he is one fine exegete. When he talks, I listen.

North has

also read and critiqued Brat, and although Brat neither mentions nor elucidates Catholic teaching, only Calvinist, and Brat and North both wholeheartedly agree usury (charging interest on a loan) is a good thing, North takes the opportunity to slam Catholic teaching and comes up very short. Let's take North apart:

Beginning in the late medieval period, the Catholic Church began to enforce laws against taking interest on loans. The justification for this officially was that the Old Testament prohibited interest on loans.

Actually usury was prohibited all along. North is a historian, he can do better than this.

This was probably the single most serious exegetical error in history of Western Christianity. It was categorically wrong. It led to a strangling of capital investment. It led to a series of obvious pretenses that justified taking interest by means of work-around arguments. Interest was not called interest.

Ummm.. how about gnosticism, or the Albigensian heresy? Come on, lighten up, Gary. Kantianism, much? How did they build all of those fantastic Cathedrals, the googles, space programs and Apple Computers of the day, without usury? It is possible usury is simply not needed, as proven throughout history? Three hundred years later the triple part deal was introduced, but not in 1250. And interest was not called interest, because the etymology of the term means "to take a loss" not "to take a gain." Etymology is a subset of history, Dr. North, check it out.

The prohibition handed over a very nice monopoly to the Jews, since they were not under the restrictions that applied to the church. They freely lent money to Gentiles at high rates of interest. They had no legal competition. It gave them a comfortable monopoly.

Whew! This is very wrong. There is nothing comfortable in that which can easily be repudiated and occasionally got you executed in that which some might engage. The expulsion of the Jews from England and Spain was hardly comfortable, and the horrors of Ghetto-isation maybe more so. Jews were expulsed from England in 1290 by Edward the Confessor, and did not return until the mid-17th century. The entire English renaissance, and a whole lotta finance going on was, as a Calvinist might put it, Juden-frei. No Jewish usury. Sure enough Pepys et al stepped into the breach, but the fact is usury got you executed if caught, Jew or no.

The problem that the Catholic church had in 1250 is the problem that is still has. Technically, the prohibition still exists. It was never justified by the Bible, and it was always bad economic policy.

The prohibition has nothing technical about it. It is absolute, and has never changed. Vix Pervenit is the last official word, the prohibition is absolute and has not changed. Well, how come then is usury so widely disregarded? Well, how come the teaching on birth control is so widely disregarded? Something like 94% rejection on birth control, 99% rejection on usury. How about that, something taught even more rejected by Catholics than birth control! Selling of indulgences was widely practiced until Luther put an end to it. Pope Adrian specifically wrote to Luther telling Luther he was right. Bishops from Peter forward have often got things wrong and taught error. What is new? The teaching of faith and morals of the Catholic Church are infallible, the Bride of Christ is not to be abused, but bishops teaching faith and morals? The pastor mustn't get too far ahead of his flock.

It took me from 1965 until about 1990 to figure out what the biblical position is. I discovered it as part of my project, an economic commentary on the Bible.

Here is the famous bottom line. The Mosaic law did impose a restriction on charitable loans. For charitable loans, it was illegal to collect interest payments of any kind.

Famous in your own mind? All that time and still got it wrong, Gary. Some serious anti-Catholicism and pride at work here. All loans are charitable events. There are no exceptions. One reason Islam is hated is they have this right: all loans are charitable events, even though you are to be paid back. If you are not paid back, certainly you are aggrieved, but Allah favors the compassionate, the idea being you forgive the debt. As Jesus says too. Investments are always skin in the game, not a guaranteed return.

The church enforced this prohibition. The state did not.

Correct! And for an anarchist to let slide the fact that the state was able to introduce something, under the rubric of a tendentious reading of Romans 13 (not North, but putative-Christian usury-queens), is astonishing. Kings brought kingdoms to ruin by contracting usury, while forbidding it to their subjects. Good old-fashioned hypocrisy where the damage was limited to the King losing his head. With the state-allowed usury, we get the horrors of mal-education, malnutrition, endless wars, subpar housing, medical malpractice, and so on ad nauseum.

Dr. North goes on..

Charitable loans were unique in ancient Israel. They were loans that were made by Jews to neighbors who had fallen into a crisis through no fault of their own. This included some non-Jews: resident aliens. These debtors were willing to agree to a specific penalty if they failed to repay the loan. They would go into slavery until the next sabbatical year. This term of slavery ended on the day that Jews today call Yom Kippur, but only at the beginning of the seventh year, also called the year of release. All non-commercial debts were canceled. Also, no planting of crops was allowed. It was part of the system of laws governing the land. This law was unique to Mosaic Israel.

Well, Israel was the first recorded instance, but not unique, proto-Hindus, indeed every major religion condemned it. Chinese philosophers condemned it. And I think I can quickly find a half dozen Rabbis that would take apart Dr. North's summary of the Old Testament in this regard.

With respect to commercial loans, there was no restriction on interest. If a person defaulted on one of these loans, he could be sold into servitude to pay the lender.

Note he does not cite the passage. I think I know why, it is not there. Next Dr. North goes too far:

Jesus specifically identified the taking of usury as legitimate in Matthew 25, the parable of the talents.

So Jesus is the master in this parable? If so, is Je

sus the stupid, greedy person in Luke 12 16-21? Is Jesus the man who loses all in the face of stronger forces, in Mark 3 27? In Luke 16:19–31 is Jesus the rich man who goes to hell and cannot be saved? In Luke 18:1-8 is Jesus the unjust judge? In Luke 18: 9-14, which one is Jesus? The tax collector or the Pharisee? Claiming a story about someone evil supports Jesus endorsement of doing evil is risky business for a Christian. Contrary to North's tendentious reading of Matthew 25 is Luke 16 1-13, where Jesus is expressly appreciative of debt forgiveness, and usury plays no role. But there is more -

The point of the parable was this: whatever gifts you receive from God, you're responsible for increasing their net value as part of the process of kingdom expansion. But to get this idea across, Jesus used the example of the moneychangers. They were bankers. They lent at interest.

Wait. What was Jesus' first act after being acclaimed King of Israel by the people? He drove the moneychangers from the temple. This brought out the old guard who confronted Jesus as to what authority Jesus had to do this, and set new rules against for the temple? If anything got Jesus killed, it was his overthrow of the economic order. That went too far for the powers that be. Apparently Dr. North stands with the Sanhedrin on this point. Dr. North would have Jesus directly contradicting himself.

Or not... look at two statements Dr. North makes in the same paragraph:

Jesus specifically identified the taking of usury as legitimate in Matthew 25, the parable of the talents.

...

That's a fairly clear statement in favor of usury.

Which is it Dr. North?

"Jesus specifically identified... taking of usury as legitimate..."

or

"..fairly clear... statement in favor of usury..."

Some serious backtracking going on. I think deep down he knows this is anti-Catholic bias, not conviction. Usury is like lying, you know it is wrong when you do it. Like lying, the more you do it the easier it gets. Dr. North has a conscience.

As to usury, referring to an article that does not mention Catholic teaching, speaking about a Calvinist trained seminarian, Dr. North offers -

The Catholic Church understood none of this. It has never has gone into exegetical detail on the supposed basis of the usury prohibition.

O dear. The world over, Muslim and Christian alike, go to John Thomas Noonan, a Catholic lawyer and author who wrote the book on Catholic exegesis on usury in 1957. Everyone cites Noonan, one way or another. As a Greek and Latin scholar Noonan can read the originals of the vast Catholic exegetical details on usury, something North cannot do. As to this book, you cannot have a copy.

But you can find one at some libraries. Noonan is now a Federal Judge, and I had lunch with him to discuss his book last year. Few topics have been so thorough covered in Catholic exegesis as usury. This statement is utterly ridiculous by Dr. North, and is I am sure just blind bigotry. The funny thing is, North would be better off reading Noonan, who claims the Church changed its teachings on usury, a point the good judge and I disagree upon. (I am right). But Noonan makes his case, exegesis by exegesis, in language by language. This comment by North is so wrong I'd imagine he would withdraw it.

There are a few screwball economic groups today that invoke the Catholic Church's position on usury, as of about 1250. These people have no training in economic thought. They are very often associated with the Greenback movement. Omni Press publishes these anti-usury Catholic books. Omni is a Greenback press.

I don't doubt this at all, and Dr. North is pitch perfect in his deconstruction of the greenbackers. So I am happy to arrive back at admiration for Dr. North. Greenbackers grab at any old straw to make their point, so Dr. North citing them is damning by association. Don't drag clowns into the discussion.

|

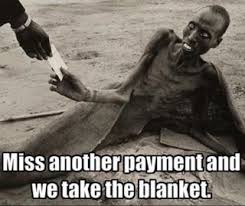

| https://2012patriot.files.wordpress.com/2011/10/debt-slaves-payments.jpg |

The Acton Institute is another very good source on economics, but fails miserably when it comes to usury. They cite apparently

with approbation Brats essay. It was a delight to watch Sirico take Lapin apart on pre-emptive torture. But no one has the whole picture, and almost no one has the picture on usury, except the immutable teaching of the Catholic Church on matters of faith and morals. Usury is wrong because it does damage, not because anyone says so.

The law is really simple: all loans are charitable events. Don't make money off of charity. If you want to make money, invest your money. It is called equity stake. Loans at interest (aka usury) are utterly unnecessary in any economy. But the ultimate end is always the same.

Feel free to forward this by email to three of your friends.